"Is it a betrayal of a righteous youth, or an unfair misunderstanding?"

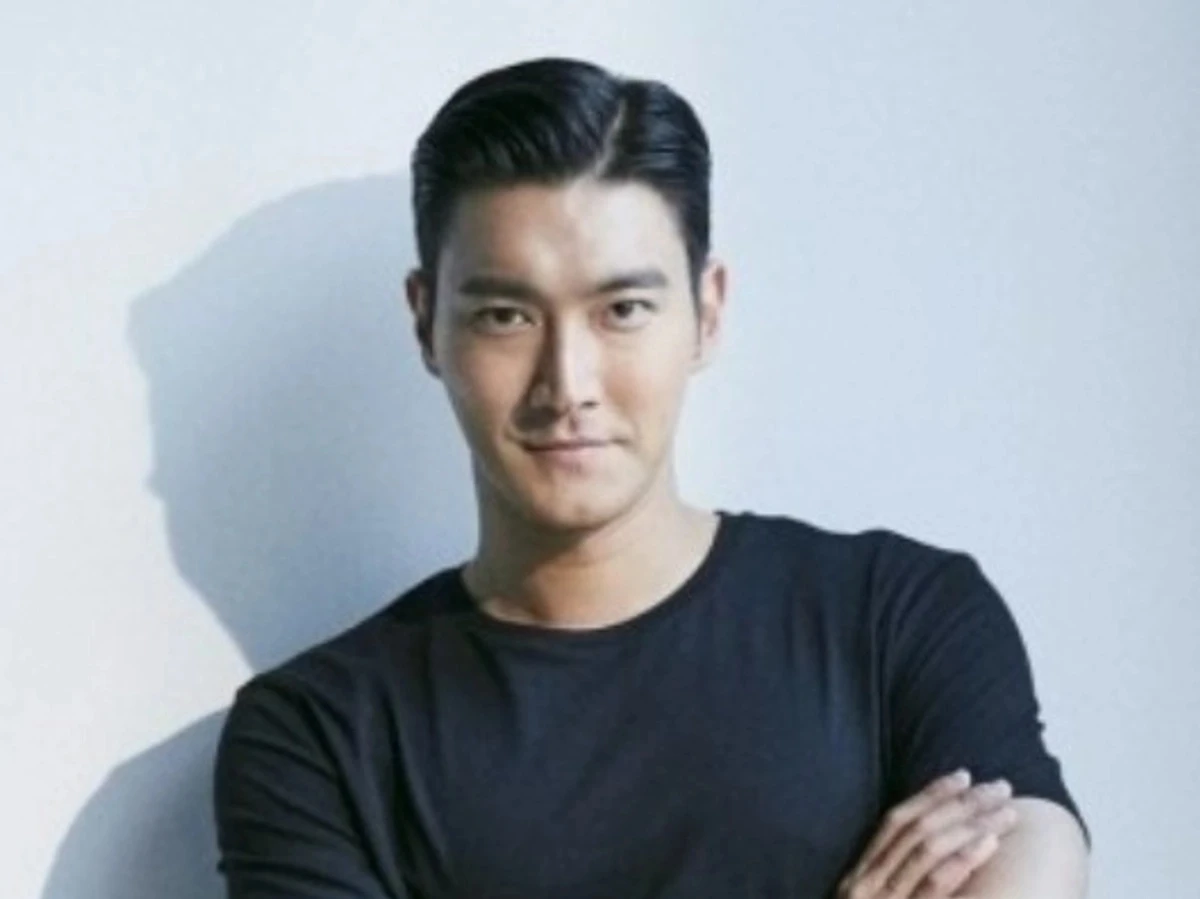

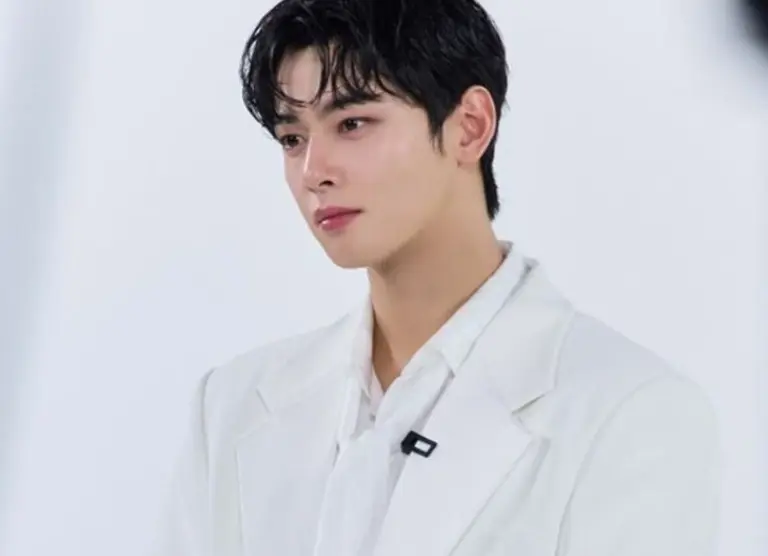

Cha Eun-woo, who has been loved for his diligent image as a representative 'perfect son' in the entertainment industry, is facing the biggest crisis since his debut. The revelation that he received a tax penalty of nearly 2 billion won from the National Tax Service due to allegations of tax evasion through a family corporation established by his mother is causing a huge uproar.

◇ "Between Tax Saving and Tax Evasion"… The Issue is 'Substantial Taxation'

On the 24th, lawyer Lee Don-ho from Nova Law Office analyzed the situation in depth through a YouTube channel. He pointed out that this incident is a symbolic case showing the dark side of 'family management' in the entertainment industry, going beyond a simple individual deviation. The key issue is whether there has been a violation of the 'principle of substantial taxation'. The crux of the matter is whether he used a trick to distribute income to a corporation with a relatively lower tax rate to avoid the personal income tax rate (up to 45%) of high-income entertainers.

◇ National Tax Service Investigation Bureau 4 Involved… "Suspicion of Paper Companies"

In particular, the involvement of the Investigation Bureau 4 of the Seoul Regional Tax Office, known as the 'grim reaper of the business world', proves the seriousness of the matter. The lawyer warned, "If income was transferred through a 'paper company' that has no office or personnel, this is a clear case of tax evasion." Whether Cha Eun-woo's mother's corporation actually performed management roles or was merely a channel for money laundering is expected to be the 'smoking gun' in the legal battle.

◇ Agency "It's Just a Difference in Interpretation" vs Cold Public Opinion

The agency Fantagio immediately took action to mitigate the situation. They claimed, "This is not intentional tax evasion, but a result of a difference in interpretation regarding the nature of the corporation with the tax authorities," and expressed their grievance, stating they would follow proper clarification procedures. However, public reaction is cold. The astronomical penalty of 2 billion won and the contrast with his previously built high trust image have amplified the sense of betrayal felt by the public. The family business, which was justified as 'filial piety', seems to have ultimately become a fatal shackle to his entertainment activities.

The final conclusion of this incident is drawing attention in the industry regarding what butterfly effect it will have on the conventional operation and accounting methods of one-person planning agencies in the entertainment industry.